Month: July 2024

David Tepper is known for his expertise in distressed asset investing. His firm, Appaloosa Management, has consistently delivered high returns by strategically investing in undervalued, financially troubled companies. Learn how Tepper’s bold moves during economic downturns have solidified his reputation as a top hedge fund manager…

Read MoreSteve Cohen’s investment principles revolve around deep market knowledge, thorough research, and risk management. His success is built on adapting to market trends, leveraging quantitative analysis, and building a strong team of specialists…

Read MoreHedge funds pool capital from accredited investors to seek high returns. Short selling, allowing profit from declines in stock prices, is a key tactic. This strategy demands detailed research, precise timing, and understanding market trends…

Read More

Investing can be intimidating, but building a diversified portfolio is one of the best ways to manage risk. Microsoft, known for its consistent performance and reliable dividends, should be a cornerstone of your strategy. Discover why and how to incorporate it effectively into your investments…

Read More

Apple pays quarterly dividends since resuming in 2012 after a 17-year pause. With steady growth and reliability, Apple’s current dividend yield is 0.55%. Despite low yield, it’s an attractive income stream for investors seeking consistency…

Read More

Machine learning is integral to Renaissance Technologies’ trading strategies, enabling them to adapt to market conditions, identify opportunities, and manage risks. Their success is driven by a blend of mathematics, computer science, and machine learning…

Read More

In today’s digital age, cybersecurity has become a cornerstone of business operations. Venture capitalists are pouring significant funds into this sector, recognizing the high demand for robust security solutions and the potential for significant returns…

Read More

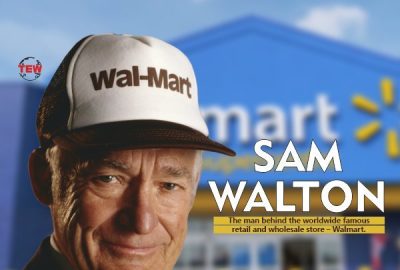

Walmart’s dividends have shown remarkable growth since 1974, increasing approximately 166,000-fold. This consistent increase has made Walmart a reliable source of passive income, enhancing total returns for long-term investors through compounding growth…

Read More

Ken Griffin founded Citadel in 1990 with $4.6 million and has grown it into one of the most successful hedge funds. Starting from his Harvard dorm room, Griffin’s journey exemplifies entrepreneurial spirit and financial acumen, making him a pivotal figure in modern finance…

Read More

Latin America is experiencing a notable economic resurgence, making it a prime target for global investors. Countries in the region have diversified into sectors like technology, renewable energy, and manufacturing, creating a more favorable investment climate…

Read More